When I started my journey as an analyst (that’s way before working for an asset manager), I struggled to see the difference between Enterprise Value (EV) and Equity Value (EqV).

Enterprise Value1 = Equity Value + Net Debt

So, Enterprise Value is the value of the firm regardless of who funded the capital. Easy formula, right? Well, the thing is that although I knew the formula and the meaning, I really didn’t understand the implications of it. Look at this ratio:

Price to Sales (P/S) = Equity Value / Sales

Is it correct?

No way!

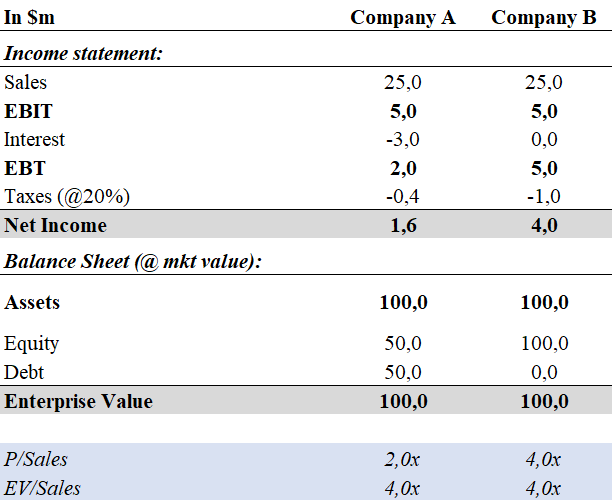

Wall Street started using such formula in the dot-com crisis to “value” companies that didn’t have profit. But the ratio is not properly constructed. Let’s see an example:

In this example, Company A looks cheaper because it achieves the same sales as Company B with half of the equity. That’s true but taking on debt has a cost. And, depending on how high it is, the debt will add or subtract value.

In this case, the return of the assets (ROA) is 5% (EBIT/Total assets). We get $5m from putting $100m of capital regardless of the origin (it can be equity or debt). That’s the reason why the EV/Sales remains constant while the P/S is lower for Company A.

However, does it makes sense to take on debt? What’s the cost of debt? In the case of Company A, the financial cost of debt is 6% ($3m of interest expense / $50m of debt). As the cost of debt is higher than the return of our assets (ROA = 5%), we can easily state that the company is destroying value by taking on debt. Does a proper ratio account for this? Yes, lets see how the P/E ratio helps us:

As you can see, if you use P/E, company B looks cheaper. And that is the correct answer. Company B is cheaper than A because we’re taking into account the cost of debt in relation to the return of our assets.

Parenthesis: For those who are advanced. All these companies destroy value because ROE is way below the Cost of Equity which in turn makes ROIC < WACC. I ignore this fact here in order to focus on using multiples properly.

Let’s see what happens if we find another company with a cost of debt that’s below the return of assets (Company C):

As you can see, the P/E ratio of Company C is the lowest of all. That makes sense because the company is funding its operations at 4% while investing at a 5% return.

Well, if it looks difficult don’t worry. Just follow this scheme all the time and you’ll fine:

Another way of looking at this is to ask you the question: is “X” readily available for shareholders? If not (because you should service debt before) then you should use metrics to the Enterprise value (examples: return on assets, EBIT, EBITDA, EV, FCFF…). If so, you should use metrics to the equity (market cap, equity…).

Example 1: the ratio EBIT/Equity doesn’t make sense because the EBIT is not readily available for the equity. The EBIT has been generated with both equity and debt.

Example 2: the ratio EBIT/EV does make sense because the EBIT is readily available for the firm. Because the firm includes the financing provided both by shareholders and debtors.

I really hope this post helped you understand better how to calculate ratios and work with EV/EqV easily.

Subscribe to get this knowledge directly into your inbox!

Enterprise Value is calculated at market prices so Equity Value = Market Cap.