Free Cash Flow (FCF) is 1 of the 3 inputs in the Discounted Cash Flow model (DCF). So, if you are a serious investor, you need to know how to accurately calculate the FCF of a company.

Thus, let’s begin!

FCF is the cashflow that generates the company after paying all the expenses and the investment needed to maintain/grow the business.

There are two types of FCF depending on how you look at the capital structure of a business:

FCF to the Firm (FCFF): the goal is to calculate the cash flow available for all the sources of capital (that is both debtors and shareholders)

FCF to the Equity (FCFE): is the cash flow available to shareholders

For now, we will focus on the FCFF because it makes valuation easier. But, don’t get worried. Once we have the FCFF it’s very easy to calculate FCFE.

Here’s an example of an hypothetical company with easy numbers:

How do we calculate FCFF from here? Here is the formula with an example:

FCFF = EBIT*(1 – Tax rate) + D&A – Capex – WK variation.

Step by step:

EBIT net of taxes is called Net Operating Profit After Taxes (NOPAT). Easy, the profit of the business after taxes.

We add back the expense of Depreciation and Amortization (D&A) because it’s a non-cash expense meaning there hasn’t been any outflow.

We subtract Capital Expenditures (capex) because the company invested that money and we don’t own it anymore.

We also subtract the investment in Working Capital (WK variation). This is a tricky one for those who are new. Basically what we are doing is adding/subtracting the dollars that we sold or owed but not cashed/payed. Example: if my receivables increased by $10m as it happened in this example, that means that we sold $10m dollars that we haven’t cashed yet. So, that “investment in working capital” has to be subtracted from the CF. Same happens, but in the opposite direction, with accounts payable.

And how do we get to the FCFE from here? Easy, we need to subtract the interest expense (net of the tax shield1) and add/deduct the change of borrowings:

FCFE = FCFF – Int(1 – Tax rate) + Net borrowing

In our example, the picture ends like this:

As you can see, the FCFE equals the total cash variation in the CF Statement above. So why do we need to do all of this to get a number that is readily available in the accounts?

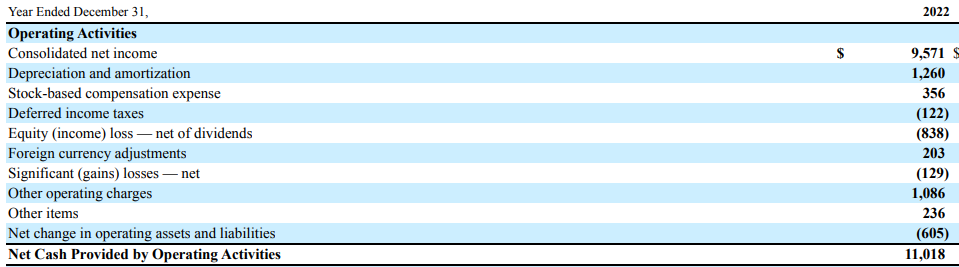

Too fast budy! In the real world, financial statements include a myriad of items that distort the picture. Just look at the CFO of Coca-Cola:

Bear in mind that the goal is to introduce numbers in the formula that are accurate. So, as an analyst you need to discern what is recurrent of what isn’t.

Now that you have the formula and the knowledge, it’s time to practice. The more you practice, the easier it will be for you to estimate how much a company is really earning.

Tax shield is the taxes not payed because interest expense is deductible. In our case $4m that is 20% of $20m interest expense.